Avalara Field

Field Description and Sourcing

Transaction Level

Company Code

Sales Tax Company Code from Branch Setup for the branch of the order is sent to Avalara. This code can be up to 25 characters.

Document Code

Invoice Number from the Summary tab is sent.

Document Date

Invoice Date from the Summary tab I sent.

Document Type

Internal flag indicating the type of invoice being requested. This is either “Sales Invoice” for a new invoice or “Return Invoice” for a voided request.

Reference Code

This is an internal pointer to the Invoice Header record in MoversSuite. Specifically, the TaxServiceID within the InvoicedHeader table. This value always starts with “DRAFT_INV” and is followed by the IHPriKey on that table.

Payment Date

Same as Document Date.

Customer Code

Customer number associated with the invoice. This may be the Customer set on the order through Billing Information or the Customer set through Add Revenue Item dialog, if the invoice item links to revenue in Transactions.

Exception Number

If an exemption is found for the Customer specified as the Customer Code, then the exemption code from Avalara is sent back after along with invoice information.

NOTE: Exemptions for customers must be established within Avalara.

Commit

Flag indicating that this is a voided (returned) invoice.

If Document Type is a return (voided invoice), then the following three fields are returned:

Tax Override Type

Date of the void.

Tax Override Tax Date

Invoice Date of the original request.

Tax Override Reason

Text of “Voiding original sales invoice”

Origin Address

Valid order addresses are included with what is sent to Avalara. These addresses are referenced as follows:

Origin Address:

Name, Address, Phone > Moving From

Destination Address:

Name, Address, Phone > Moving To

If either address is not valid, then no address is sent for the transaction level information to Avalara.

See information in the Detail Level below for address information included with each invoice line item.

Destination Address

Detail Level

For each invoice line item on the invoice, the following are sent and show in the line items detail within Avalara:

Number

Line sequence of the item on the invoice, i.e., “1” for the first line, “2” for the second line, etc.

Amount

Dollar amount of the line item. This value is negative if the invoice is being voided.

Item Code

MoversSuite Item Code for the item is sent. The Revenue Group description or the adhoc group description is reference when no Item Code links to the invoice item.

Description

Line item description from the invoice item or group.

Tax Code

If the Item Code maps to a Tax Code within Avalara Tax Code Setup, then that Tax Code is returned with the item.

Quantity

Quantity associated with the line item is sent. Of note, this value cannot be 0 in Avalara, therefore if a 0 quantity is specified in MoversSuite, the application returns 1 to Avalara.

Origin Address

The application checks for a valid address starting with the Revenue Group and then checks the Revenue Item. By default, the address referenced for either group or item is the Origin Address set on the order. This address is set for both the Origin and Destination Addresses.

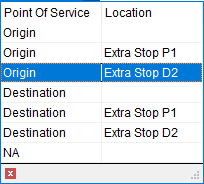

Optionally, this default can be updated to reference a different origin or destination or be specified as not applicable. This update is based on the Point of Service setting within the Add Revenue Group and Add Revenue Item dialogs.

The Point of Service works by overriding the defaults of the order. If the service location is known, then setting the Point of Service assigns the selected address as both the Origin and Destination Addresses on the line item. For example, if you select “Origin”, then Origin Address of the order is assigned to the line item for both the Origin and Destination Addresses.

The “Destination” option works in similar fashion by assigning the Destination Address of the order to both Origin and Destination Addresses on the line item.

“NA” instructs the application to mark both Origin and Destination Addresses as not applicable.

If there are Extra Stops on the order, then each stop can be assigned as the Origin and Destination Addresses on the line item. In the example below, if the Origin – Extra Stop D2 address is selected, then the address for the 2nd delivery stop is set as both Origin and Destination Addresses.

Addresses referenced for the line item are as follows:

Origin Order Address:

Name, Address, Phone > Moving From

Destination Order Address:

Name, Address, Phone > Moving To

Extra Stops Location

Extra Stops > Add Extra Stop > Address Information

Destination Address

Address

The Address indicator on line items details in Avalara references the source of the address, which is specified through the Point of Service selector within both the Add Revenue Item or Add Revenue Group dialogs. By default, this is set to “Origin” (whether it shows or not in the selector). Optionally, it can be set to “NA” or “Destination.” See the notes for the addresses above for which address is included for this selector.

Of note, for “NA”, the application sends the Origin address, i.e., acts the same as the default of “Origin.”

The following values are sent for the Point of Service (shows as Address for the type of tax on a detail item):

Origin: 1

Destination: 2

NA: 3