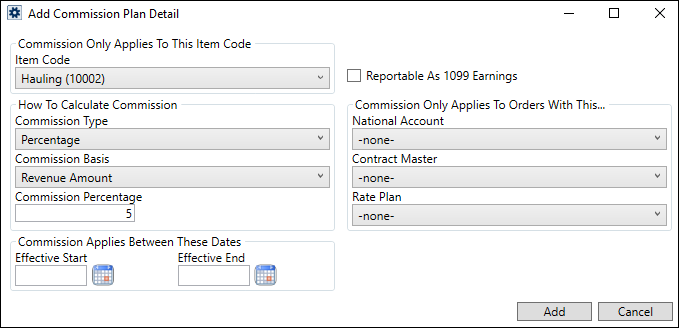

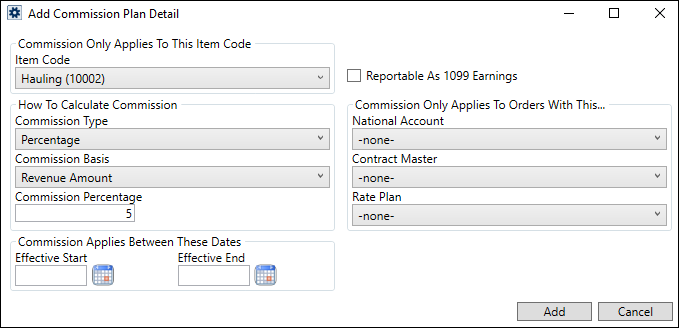

Add and edit details of a commission plan through the Add Commission Plan Detail dialog. This dialog appears when adding or editing Commission Plan Detail items within the Commission Plan Setup.

Figure 39: Add Commission Plan Detail dialog.

A commission plan can be defined either based on National Account assignment or you can qualify based on Contract Master and/or Rate Plan. However, if the National Account is selected, then Add Commission Plan Detail screen is updated to disable Contract Master and Rate Plan dropdowns.

When computing commissions, the application will determine which detail record to use based on what is set for the order in the following progression:

1. First check the National Account.

2. If no match on National Account, check the Contract Master, then

3. Check the Rate Plan, then, lastly,

4. Reference the default record (none set for any Commission Only Applies To Orders With This option set)

This change also affects the Auto Commissions process while determining which plan to reference.

Technical Field Information

The following table provides descriptions for fields associated to this setup area.

|

Field |

Description |

|

Commission Only Applies To This Item Code | |

|

Item Code |

Select the Item Code needed to generate commission transactions (see Item Code Setup). The application generates commissions for personnel associated to revenue linked to this particular Item Code. |

|

|

Reportable As 1099 Earnings

Set this flag if commissions on this plan are 1099 reportable. If the commissionable parties associated to this commission detail receive a 1099 at the end of the year (instead of W2) then mark this as 1099 reportable. |

|

How To Calculate Commission | |

|

Commission Type |

Commission Type determines how the Commission Amount is interpreted as either a flat rate, a percentage of revenue line item, or by as a 100-weight amount based on the weight of the order.

NOTE: The Commission Type set will determine the options that are available for Commission Basis. Only relevant Commission Basis options will be offered for the Commission Type chosen.

Select from the following types:

% of Hourly Rate Select % of Hourly Rate type to calculate commissions based on a percentage of the assigned revenue, which is based on what is specified for the Commission Percentage of Hourly Rate specified in the Commission Plan Setup.

Flat Rate The system interprets the Commission Amount value as a flat dollar amount, e.g., “25.50” is a commission of $25.50. This is the dollar amount charged for services provided. If a surveyor receives a $75 fee each time they go out, then the Flat Rate for their type is $75.

Hourly Pay The Hourly Pay type calculates the commission based on a flat rate on the number of hours worked. The default rate is supplied through the Commission Amount Per Hour setting.

Miles Select Miles to calculate commissions based on the Miles set on the order within the Move Information tab (or the Billing Information (Revenue Entry)). The Add Revenue Commission dialog provides information on the Order Miles along with a Miles Factor, which is the Commission Amount from this record. If you wish to base the commission as ten cents per mile, then set the Commission Amount to .10 and set the Commission Type to Miles. Additionally, you can modify the Miles default set for a miles-based commission through the Add Revenue Commission dialog.

Percentage If the commission is based on a certain percentage of the revenue line item, then select this option to interpret the Commission Type as a percentage of the revenue associated set forth by the Commission Basis, such as a certain percentage of the invoiced amount. Example: Let’s say we have a 10% commission percentage based on the invoice amount of $1,000. Therefore, the Commission Amount is “10”; the Commission Type is “Percentage”; and the Commission Basis is “Invoice Amount”. A commission of amount of $100 (10% of $1,000) is computed based on these settings.

Weight This option computes the commission as a 100-weight value based on the weight of the order. For example, if the Commission Amount is “10” and the weight of the order is “5,000”, then the commission amount is $500 (5,000/$10). The weight of the order that the Weight basis references is the Hauled Weight (as set through Move Information); it is referred to as the Order Weight within the Add Revenue Commission dialog. |

|

Commission Basis |

The following basis values are available and relate to fields found in Add Revenue Item and Add Revenue Commission. For example, if the Commission Type is “Percentage,” the application computes the commission based on a particular transaction amount.

NOTE: Once Commission Type is chosen, only relevant Commission Basis options will be offered.

Invoice Amount MoversSuite bases the commission on a percentage of the Invoice Amount of the revenue item; Gross Charges less any Discounts

Net Amount MoversSuite will base the commission on a percentage of the Net Amount of the revenue item; Invoice Amount less any Reductions

Revenue Amount Invoice Amount, MoversSuite will base the commission on a percentage of the Revenue Amount of the revenue item; Invoice Amount less any Discounts and Reductions. This is considered a bottom line retained amount, such as for packing labor. |

|

Commission Amount Per Mile Commission Percentage Commission Amount Per CWT |

The system interprets the value entered here based on the selected Commission Type (see Commission Type for usage). For example, if the Commission Type is set to “Percentage” then “100” entered in this field is interpreted as 100% commission for the item. |

|

Commission Only Applies To Orders With This… This section simply qualifies the Item Code. For example, if National Account is specified, then for revenue under the Item Code to be eligible for commissioning, then what is set for the National Account must match that set for the order. Otherwise, you can qualify based on either a combination of Contract Master and/or Rate Plan set on the order. This section has no bearing on how the commission is actually calculated. | |

|

National Account |

Select any of the National Accounts defined through the Account Setup. Selecting any of the accounts will automatically disable the Contract Master and Rate Plan fields. |

|

Contract Master |

If paying the commission from a specific contract, then select the contract from the list of those defined within Contract Master Setup.

If a contract is assigned to a Commission Plan detail record in Administration, the contract cannot be set as Inactive. See Contract Master Setup for more detail. |

|

Rate Plan |

If paying the commission from a specific rate plan, then select the plan from the list of those defined within Rate Plan Setup. |

|

Commission Applies Between These Dates | |

|

Effective Start Effective End |

Enter the date range that this detail record is in effect (in MM/DD/CCYY format). The dates selected here are evaluated based on the date selected for the commission plan through the Effective Date Basis setting. Enter one or both dates. If the end date is not, for example, the commission is in effect indefinitely. If no date range is entered, the detail record is automatically in effect (and displays with “No Start Date – No End Date” within the Commission Plan Detail listing. Press the calendar icon ( |

RELATED TOPICS: