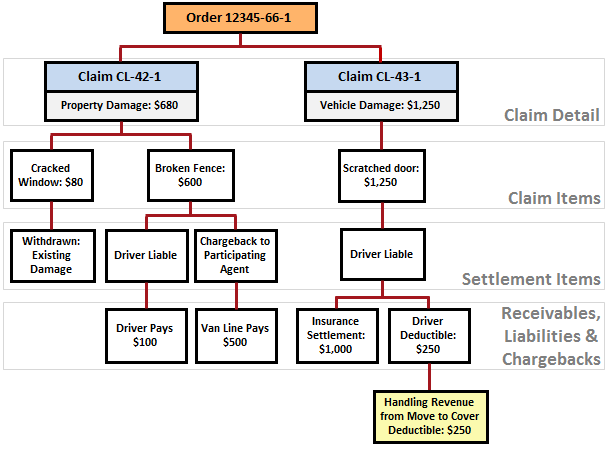

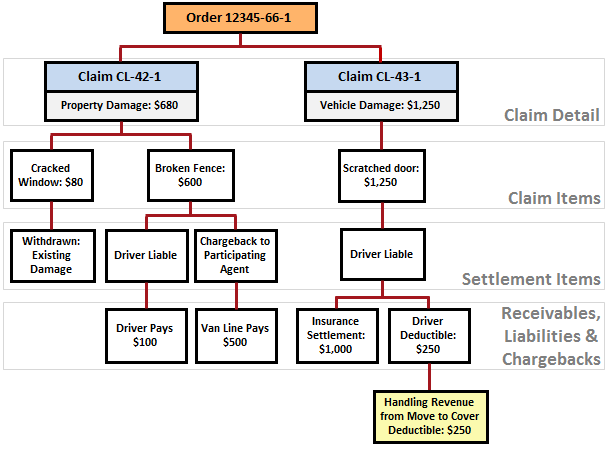

The following diagram illustrates the general claim process flow within the Claims System.

Figure 23: Claims Process Overview diagram

The following table describes the components of the Claims System.

|

Component |

Description |

|

Order Number |

Claim Systems requires an Order Number set through Claim Detail. |

|

Claim Records |

Multiple claim records can exist for an order for the primary purpose of distinguishing between multiple payees per order and/or multiple claim types processed; the Type set within Claim Detail determines which Damage Type and Denial Code values are available for the claim items. In the above example, there are two claims, CL-41-1 and CL-43-1, against Order Number 12345-66-1. Users can manage claim records through the Claim Detail screen. |

|

Claim Items |

Users can set up multiple claim items for each claim. Claim items detail the specifics of the claim that a company must settle to satisfy the claim record. Description examples of claim items include “Cracked Window,” “Broken Fence,” and “Scratched door.” Users can manage these records through Claim Items. |

|

Settlement Items |

These items represent the actual cost of the claim, such as paying a vendor to fix a couch or cashing the item out. Description examples of claim items include “Cracked Window,” “Broken Fence,” and “Scratched door.” Settlement types assigned to such records may include “Closed,” “Withdrawn,” “Cashed Out.” Users can manage these records through Settlements. |

|

Receivables |

These items represent amounts received by the company from a particular customer to satisfy part or all of a claim item. They typically are in the form insurance payments or van line reimbursements applied to company expense. Users can manage these records through Receivables. |

|

Liabilities |

These items represent the amount assessed to others for their responsibility on the claim, such as defining an employee as the Liable Person. Users can manage these records through Liabilities/Chargebacks. |

|

Chargeback |

Chargeback occurs for liabilities charged back to a participating agent or warehouse agent. Assigning responsibility to a Participating Agent for transportation damage is such an example. Users can manage these records through Liabilities/Chargebacks. |

|

Handling Revenue |

This is an amount received by the company for handling the claim from one of its affiliates. Users can manage these records through Handling Revenue/Expenses. |

|

Handling Expense |

If the company is paying an affiliate to handling the claim, or part of the claim, for them, then enter it as a Handling Expense. Users can manage these records through Handling Revenue/Expenses. |

Users will use Payment Management and Revenue Entry to process any monetary transactions that occur for claim items.