Keyboard Shortcut: Alt, E, P

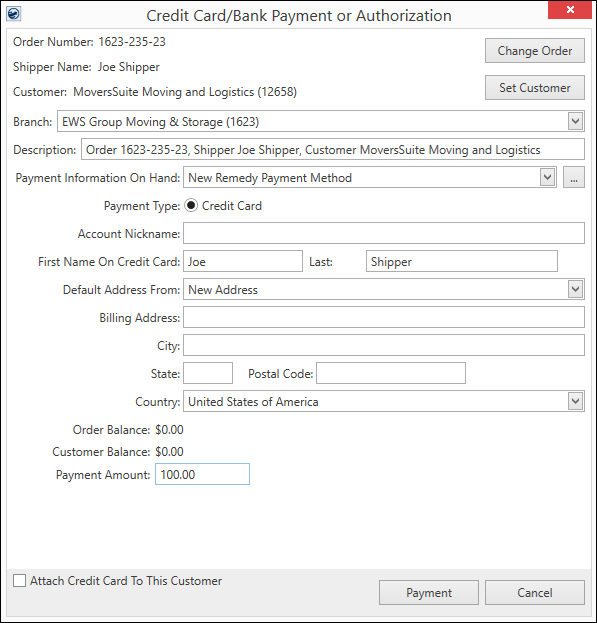

The Credit Card/Bank Payment or Authorization option is found on the Electronic Payments Menu. Open it from an order to associate the payment with the order number and/or customer.

NOTE: The videos related to this topic are Electronic Payments - Process a Payment and Electronic Payments - Authorizations. In addition to clicking the hyperlinks to view the videos, the videos can also be found in the Online Help under Electronic Payments (Videos).

Utilize the Credit Card/Bank Payment or Authorization screen to process a payment on a credit card or by bank account or to authorize a future payment. Uses for this option include:

•Processing a single payment

•Pay an invoice

•Establish the payment method for the order and/or customer

•Reprocess a payment with a provided Approval Code

•Request an Authorization. (Authorizations are only allowed if the Electronic Merchant Setup is set to allow Authorizations. for CSI Pay is set to allow Authorizations. See Electronic Merchant Setup (CSI Pay) and/or Electronic Merchant Setup (Remedy) for details.)

Some examples of its use are:

•Customer is on the phone and wishes to pay an invoice directly by providing card or account information to you.

•Customer gives you information to authorize an amount and retain the credit card information for further authorizations

•Customer mails you the credit card/bank account information to pay an invoice.

•You or customer receives an Approval Code to reprocess a payment.

•Someone off the street wishes to pay for something (no order or customer)

For information on the screens that are prompted once the Payment or Authorize button is clicked:

•If a credit card payment or authorization is processed by Remedy, go to Remedy Payment Page for the next steps in the process.

•If a credit card payment, bank account payment or a credit card authorization processed by CSI Pay (PYXis), go to Secure Payment Form for the next steps in the process.

Figure 14: Credit Card/Bank Payment or Authorization screen depicting Remedy as payment processor

Access to this screen is through the following locations within MoversSuite:

• Electronic Payments Menu > Credit Card/Bank Payment or Authorization

• AR Credit & Collections > right-click on AR Detail record

• Long Distance Dispatch > Current Driver Activity

• Long Distance Dispatch > Orders

NOTE: If you access the Credit Card/Bank Payment or Authorization screen from the Contents Screen all order and customer default settings are not set.

The Credit Card/Bank Payment or Authorization screen is followed by a secure hosted payment page or, if using the Web Page Around Hosted Page (tab) option, to the Electronic Payment Processing Page for Remedy or Electronic Capture Processing Page for CSIPay (PYXiS).

See Electronic and Online Payments for information on accessing this screen.

Technical Field and Function Information

The following table describes the fields and functions available within the Credit Card/Bank Payment or Authorization screen. Refer to the Electronic and Online Payments for additional use information.

|

Field/Function |

Description |

|

NOTES: •You can use this screen without specifying an order or customer. If you wish to not have defaults set for the order and customer, then open this screen from the Contents Screen. •Setting the order and/or customer on the payment populate the payment description, name on card, address, and balance information as well. •All text entry fields are 255 characters or larger in length. | |

|

Order Number |

If the payment associates to an order, then the Order Number of that record displays. |

|

|

Change Order Use this function to assign an order to the payment. Pressing Change Order opens the Find screen allowing you to search and locate the appropriate order. |

|

Shipper Name |

The name on the order associated to this payment displays. The Shipper Name pulls from the name set on the Name, Address, Phone tab. |

|

Customer |

If the payment associates to a customer, then the customer assigned to the order displays. Alternately, you can use the Set Customer function to change the customer on the payment and, optionally, update the customer on the actual order as well. If you wish the payment information to be retained for future payments associated to this customer, then check the Attach Credit Card to this Customer flag (below). |

|

|

Set Customer This function opens the Customer Find screen allowing you to open select a different customer on the payment and, optionally, update the customer on the order as well. |

|

Branch |

Select the branch that you want this payment processed under. A cash receipt generates for this branch and is available for processing within Cash Receipts and Payment Management under the title of “Electronic Payment” followed by the branch number. This branch defaults to the branch assigned to the order, if specified. Alternately, a different branch can be selected from the list. This list includes branches available to the merchant service provider (through Electronic Merchant Setup) and those that the user can access (through Security Profile Setup records assigned to the Cash Receipts module). |

|

Description |

This is the description for the electronic payment. By default, the application builds this description from the Order Number, Shipper Name, and Customer assigned to the payment. You can overwrite the default and enter your own description. This description follows the transaction through payment processing on to Cash Receipts (as a Note on the receipt) so please make sure that the information it contains makes it easy to locate this record. |

|

Payment Information On Hand |

Select the type of payment you wish to use to process this payment or, if an authorization, which payment method to check for authorization. By default, this field is set to “New Payment Method”; however, you can select from a list of payments that have been retained for the shipper or customer. When either or both Retain Card for Future Payments option and Attach Credit Card To This Customer are checked on a previous order, the information is retained and shows as an option in subsequent orders.

For CSI Pay (PYXiS): To retain payment information for future use, both Retain Card for Future Payments option and Attach Credit Card To This Customer m be checked (both located at the bottom of the screen).

For Remedy: To attach payment information to this Order or Customer for future use, check the Attach Credit Card To This Customer, located at the bottom of the screen.

Press the ellipses button to access the screen Payment Method Management, from which you can manage the active status of a payment, set a nickname, and, if the processor allows, attach/remove a customer from the payment. NOTE: Changes to the payment information through this screen are not logged as activity for a Recurring Payments. If you wish to change this data and have a record of it, access the Payment Method Management screen through the AutoPay Setup (Recurring Billing) tab. |

|

Payment Type |

The application sets up the secure hosted webpage based on the type selected here (accessed by pressing Payment). The Payment Type options available are dependent on what is selected for the service provider within the Electronic Merchant Setup.

The Payment Type shown is dependent on the Payment Information On Hand selected.

For CSI Pay (PYXiS): Payment Type does not appear when CSI Pay is chosen as the Electronic Merchant because the Payment Type Options are chosen on their secure hosted webpage (which appears after the Payment button or the Authorize button is clicked.) The Payment Type options that will be available for CSI Pay are: Credit Card - Process a credit card for the payment. The secured hosted pageprompts for the Card Number, Expiration Date, and CSC Code (security code).

Bank Checking - Process a bank checking account for the payment. Their secure hosted webpage prompts for the Account Number and Routing Number of this checking account.

Bank Savings - Process a bank savings account for the payment. Their secure hosted webpage prompts for the Account Number and Routing Number of this savings account. |

|

Account Nickname |

Update or set a nickname for the payment method (up to 40 characters). The nickname allows the method to be differentiated from other methods, making it easier to identify through the Payment Information on Hand setting and when selecting a payment for storage billing through the Payment Method Management screen or through the Payment Method selector within the Payment Setup tab. |

|

Name On Credit Card Name On Bank Account |

Provide the name on credit card or the name on the bank account that the payment processes under. |

|

Default Address From |

Select the address type you wish to reference to populate the billing address. Options from this menu include “New Address,” which you specify if you wish to enter the billing address manually, and from a list of addresses populated for the order and customer records. For example, if you wish to populate the billing address from the Moving From address on the order (from Name, Address, Phone), then choose the “Origin Address” option and the billing address updates accordingly. Address types only list in this menu if there is an actual address assigned to the specific entry. For example, “Destination Address” only appears if the order has the Moving To address set (Name, Address, Phone). Also available to select from are any Extra Stops on the order. Customer address types pull from Microsoft Dynamics GP. The list under their billing source, e.g., PRIMARY, SECONDARY, etc. |

|

Billing Address |

The Billing Address is the address that the credit card/bank account itself is billing to. When a merchant provides this information as part of the electronic transaction, then this additional information is used to reduce fraud through the Address Verification Service provided by the card networks. This information then reduces the fee the merchant gets charged on this transaction. At a minimum, supply the zip code. Use the Default Address From setting to fill-in data for the billing address automatically from the order or customer associated to the payment. Alternately, choose “New Address” to enter the billing address by hand. The Billing Address populates the corresponding address referenced within the secure hosted webpage. |

|

Order Balance |

The amount of open revenue associated to the order on the payment displays. This amount pulls from data managed within Microsoft Dynamics GP through the Data Warehouse (refer to Data Warehouse Refresh for more information). This information is provided as a reference only. |

|

Customer Balance |

The amount of open revenue associated to the customer on the payment displays. This amount pulls from data managed within Microsoft Dynamics GP through the Data Warehouse (refer to Data Warehouse Refresh for more information). This information is provided as a reference only. |

|

Payment Amount |

Provide the amount you want to process for this payment. |

|

Authorize Only |

Check this option to send a link for an Authorization. Authorizations must be attached to an order. Cash Receipts are not generated as this is only an “pre-authorization” and not an actual charge. Once clicked: •the Payment Amount field is renamed Authorize Amount. •the Payment button at the bottom of the screen changes to read Authorize. • If successful, the System email setup option for approved authorizations can be sent to the customer using the Electronic Authorization Success screen. |

|

|

An Amount must be entered within Payment Amount to proceed. Once an Amount is entered, the error message will disappear. |

|

Retain Card for Future Payments By default, this flag is checked. When checked, the application is instructed to reference this credit card or bank information for future payments for the order specified through the use of tokens.

This is also used in conjunction when the link is for an Authorization and the Authorization checkbox is checked (if your provider offers Authorization.)

When checked, the payment information provided is available as options within the Payment Information On Hand setting within this screen and with the Payment Method setting the Payment Setup tab (for recurring online payments).

If not checked, the charge can only run the one time on that credit card.

NOTE: MoversSuite does not store any credit card or bank account information and relies on encrypted tokens to reference the information through secure channels from the merchant service provider. | |

|

|

Attach Credit Card to this Customer This flag is dependent on the processor chosen within Payment Information on Hand.

IMPORTANT: The Retain Card for Future Payments option must be checked to properly use this Attach Credit Card To This Customer option, as tokens are needed for this function.

Check this flag if you wish to associate the payment information referenced for this transaction with the customer for future payments. If checked, the payment information will be available as a payment option on other orders that are using this exact customer number. |

|

Or Authorize |

Payment Press Payment to continue within processing the payment. This function opens a secure hosted webpage, which connects MoversSuite to the merchant service provider.

IMPORTANT: Pressing Payment generates a cash receipt for this payment. Therefore, if you cancel out of the subsequent secure hosted webpage, then the cash receipt is voided, i.e., uses (or wastes) a cash receipt number.

|

|

|

Cancel Cancel the payment request and close out of this screen. |