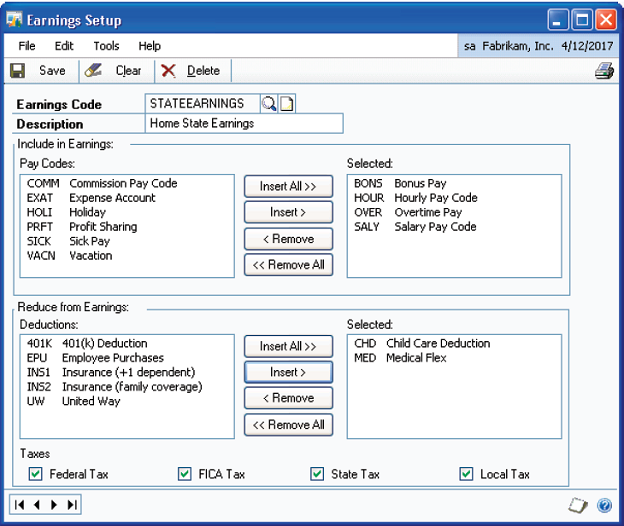

Use the Earnings Setup window to define earnings codes. Earnings codes are used in US Payroll to determine the amount of earnings to apply to deduction calculations. To open this window, click the HR & Payroll series button and click Earnings Setup on the Setup content pane.

FIGURE 23: EARNINGS SETUP WINDOW

Wages and deductions used to calculate net disposable income may vary from state to state, so a unique Earnings Code can be created for each state, if necessary.

Select the pay codes that should be used in calculating earnings, and select the deductions that should be used in reducing earnings. Options to include taxes are also available. Once an Earnings Code is saved, it can be assigned to a garnishment deduction record, if the appropriate deduction method was selected in Deduction Setup.