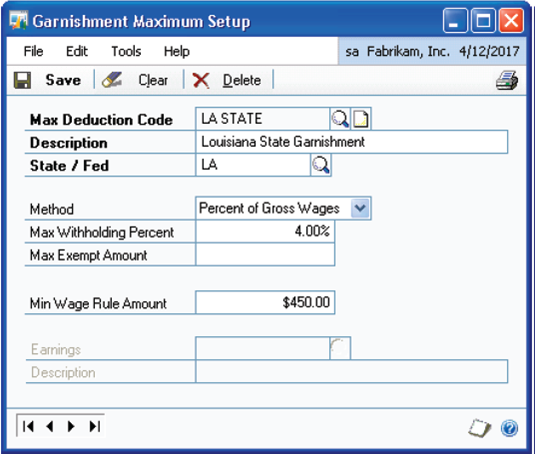

Use the Garnishment Maximum Setup window to define the state and federal maximum rule calculation for a particular garnishment category. To open this window, click the HR & Payroll series button and click Garnishment Maximum Setup on the Setup content pane.

FIGURE 22: GARNISHMENT MAXIMUM SETUP WINDOW

Federal and most state governments in the United States establish maximum rates and amounts for garnishment of wages for individuals. This information should be entered in the Garnishment Maximum Setup window.

When setting up a deduction record in Deduction Setup, a deduction type of Garnishment is available. If selected, a Garnishment Category can also be assigned, which is used for reporting purposes.

The options available include:

• Support Order

• Tax Levy

• Bankruptcy

• Garnishment

• Other

A new method, Percent of Earnings Wages, is available for deductions. Since many garnishments are based on net disposable income, you can select this option, and then define what taxes and other deductions are included when calculating this amount using the Earnings Setup window. An Earnings code should be assigned to each garnishment deduction where this method is selected.