You can refund a partial or full amount of an electronic payment. To refund a payment you can do the following:

•Void a cash receipt for the electronic payment (see Electronic Payment Void Receipt)

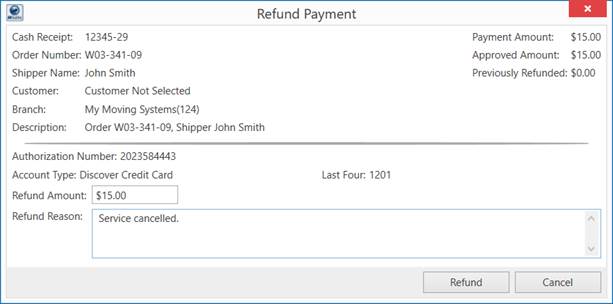

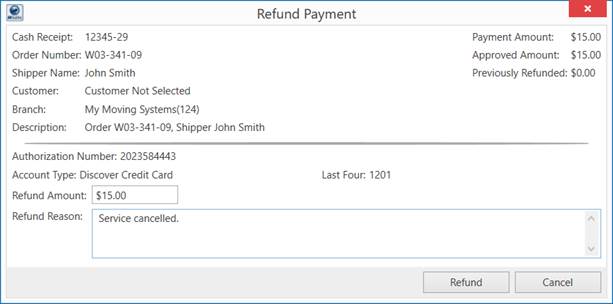

•Utilize the Refund option available from within the Cash Receipts module. This opens the Refund Payment screen allowing you to refund the full or a partial amount of the original payment.

The following occurs depending on whether you are refunding full or partial amount of the original transaction and when in the processing cycle the refund is issued.

Partial Refund

If you issue a partial refund, an amount refunded is less than the full amount of the payment, then the original cash receipt remains as is and a new, negative payment for the amount of the refund is created. This subsequent refund payment is placed in a separate batch within Payment Management with a title of “Electronic Refund,” since it is not a cash receipt (negative amount).

Full Refund

Depending how long after the original payment was processed, a full refund may be handled like a partial refund (described above). If the refund occurs on the same day as the original payment and the batch is not yet “In Process” within Payment Management, then original payment is voided; the status of the cash receipt is set to “Voided” (Cash Receipts) and the payment is also voided with the merchant service provider. Otherwise, the refund is treated like a partial payment.

When refunding an electronic payment, the application produces the Refund Payment screen. From this screen, the application prompts you to enter a reason for refunding the payment.

Figure 50: Refund Payment

If the refund is successful, the Electronic Refund Success dialog appears. Otherwise, you encounter the Electronic Refund Failure dialog.

If you receive an error when attempting to refund, nothing occurs within MoversSuite.