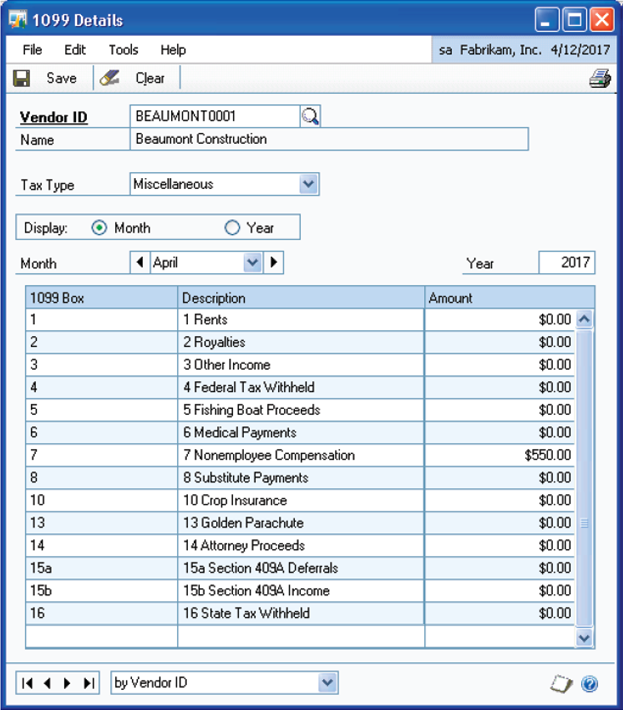

Use the 1099 Details window to enter amounts for 1099 boxes when setting up vendors in the middle of a calendar year, or editing 1099 amounts. To open this window, click the Purchasing series button and click 1099 Details on the Cards content pane.

FIGURE 18: 1099 DETAILS WINDOW

Amounts for each vendor can be tracked for each Tax Type. Make a selection to display the appropriate 1099 box information. To enter or edit 1099 amounts, select to display monthly totals. If you display amounts by year, the amount field for each box is not editable. If an amount is entered or changed, click Save on the window toolbar.

NOTE: Amounts should not typically be changed after you start using Payables Management. If amounts are changed in the 1099 Details window, no supporting transaction information is present in Payables Management If the reconcile process is run, the amounts entered in this window are lost.

Click on the Printer icon on the window to generate a Vendor 1099 Details Monthly Report. Use this report to verify that the correct amounts were entered for each of the 1099 boxes.

There's also a 1099 Details Inquiry window that provides inquiry only access to these 1099 amounts for vendors. Amounts can be viewed for each Tax Type by month or year; amounts cannot be changed in the inquiry window. Links to this window exist in the Vendor Period Summary Inquiry and Vendor Yearly Summary Inquiry windows.