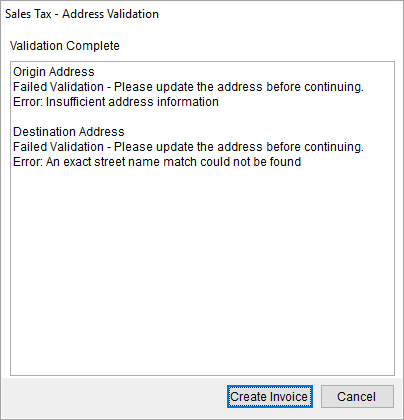

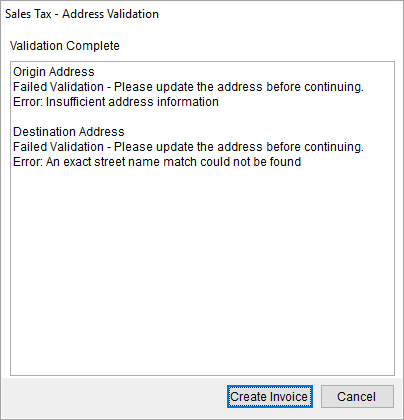

The Sales Tax Address Validation dialog appears when an address linked to a revenue item is incomplete or invalid. This dialog appears as you attempt to create or edit an invoice through the New Complete Invoice screen. Sales Tax Integration requires valid addresses.

Figure 37: Sales Tax Address Validation dialog

The Sales Tax Address Validation feature is only available when the Automatic Address Validation flag is checked within Avalara Interface Setup. If this flag is not checked and there are address errors, then they are returned to you when data is sent to Avalara.

The addresses validated include the following based on what is set or not set at either the revenue group or revenue item level. Refer to the address information within the Detail Level in Avalara Integration Data topic for specifics. In general, the following addresses are the only possible addresses validated:

Origin Order Address:

Name, Address, Phone > Moving From

Destination Order Address:

Name, Address, Phone > Moving To

Extra Stops Location

Extra Stops > Add Extra Stop > Address Information

Press Create Invoice to continue to the New Complete Invoice screen without correcting any address errors.

Technical Field and Function Information

The following table describes the fields and functions that display within this dialog.

|

Field/Function |

Description |

|

Validation Complete |

The application processes all addresses associated to all featured revenue items and returns a list of errors associated to each address. The address type specified, e.g. Origin Address, is documented within the Avalara Integration Data topic and links to the Point of Service setting on the revenue item established within Add Revenue Item or Add Revenue Group. |

|

|

Create Invoice Press this button to continue to the New Complete Invoice screen without correcting the incorrect addresses. |

|

|

Cancel Press this button to cancel invoice creation. |

RELATED TOPICS: