A fuel surcharge is a percentage adjustment to moving costs that is based on the price of fuel as reported by the U. S. Department of Energy (DOE).

You can implement a fuel surcharge rate structure by utilizing a Rate Matrix record along with defining fuel charges that trigger the rate lookup based on the Load Date of the order. The result of the setup is an invoice, quote, and/or revenue line item that pulls in a rate based on the fuel charge that you can manually apply to a linehaul amount of a move.

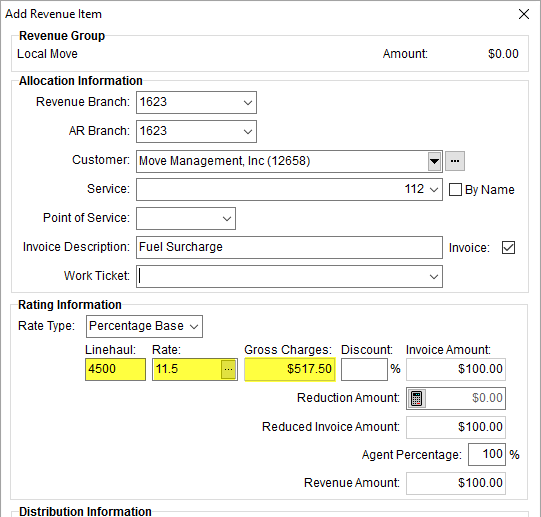

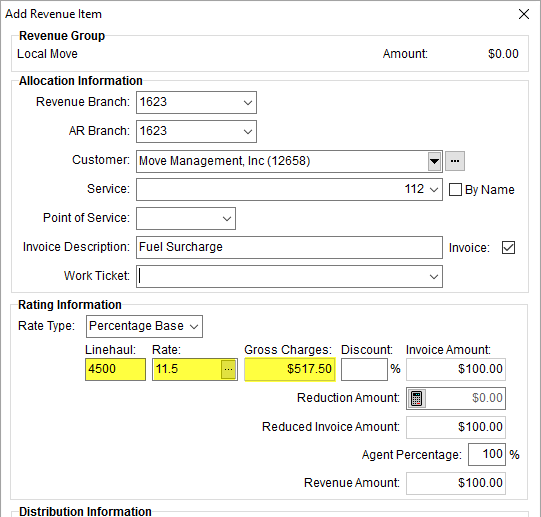

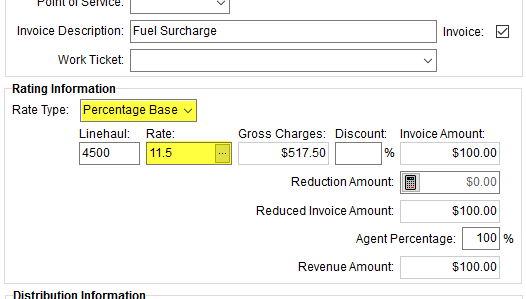

In the following example (Figure 15), a rate amount of 11.5% is applied to a linehaul amount of $4,500. From which, a $517.50 charge is computed based on 100-weight calculations.

Figure 15: Add Revenue Item

In the example above, the field labelled Linehaul can read as any label you like. This field is customizable within Rate Type Setup. This and other setup information is discussed in the following sections.

A fuel surcharge can affect rates applied in the following areas:

Fuel Surcharge Setup

Setting up a fuel surcharge involves the following steps:

1. Adding Fuel Cost Setup records

2. Creating Rate Matrix Setup records to support various surcharge rate tiers

3. Add a Rate Type Setup record to support fuel surcharges

4. Update Rate Plan Setup records to have rates reference the surcharge Rate Type and supporting Rate Matrix

5. Verify the fuel surcharge item(s) works for quotes, invoices, and revenue creation

STEP 1: Add Fuel Cost Records

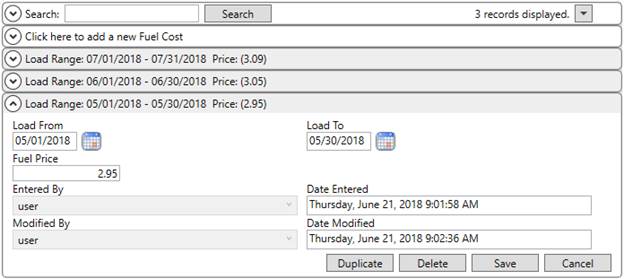

Reference the Fuel Cost Setup to establish current Fuel Price records for a specified timeframe, which can be any period such as weekly, monthly, quarterly, etc. Create records for each known fuel price change.

The Load From and Load To dates are the effective dates that the Fuel Price is active. The application references the Load Date of the order to determine whether the rate is in effect. Specifically, the application checks the Actual Load Date, then checks the first date in the requested Load Date spread to determine which rate applies.

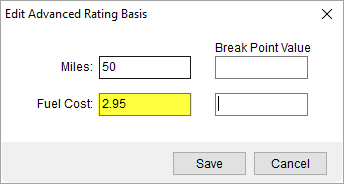

In the example below, moves occurring during May of 2018 are subject to a Fuel Price of $2.95.

Figure 16: Fuel Cost Setup

The application references the Fuel Cost when creating the invoice, quote, or revenue item. It is visible through the Edit Advanced Rating Basis dialog (see Step 5).

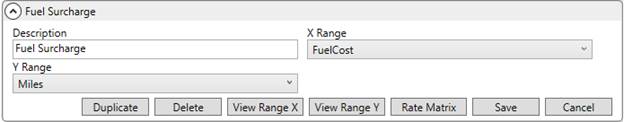

STEP 2: Add Rate Matrix to Support Fuel Surcharge

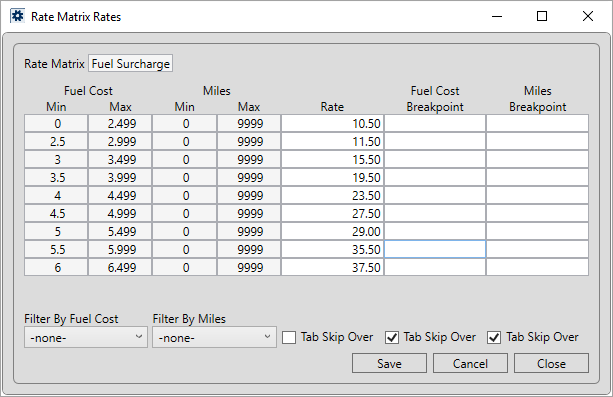

Create a Rate Matrix record within Rate Matrix Setup to retrieve a fuel surcharge percentage based on the current fuel prices. Set the X Range to Miles. Please note that order miles are not actually referenced for the lookup, however, the X Range is needed to support the Y Range of FuelCost.

Figure 17: Example Rate Matrix Setup

The Description can be any name that works for you.

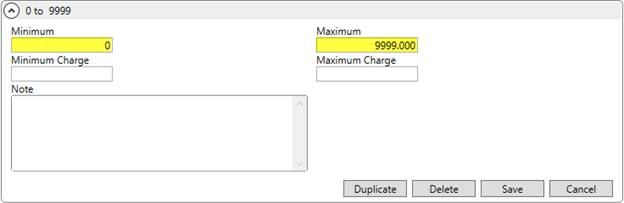

Once the Rate Matrix is established, click on View Range Y to open the View Rate Matrix Range Y Details screen to establish a single range of 0 to 9999 for the Minimum and Maximum values.

Figure 18: View Rate Matrix Range Y Details screen

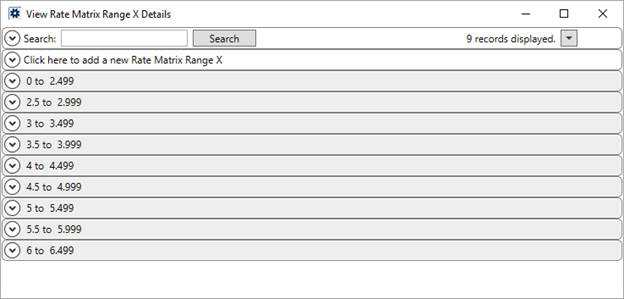

Save and close out of this screen and open the View Range X. Use the View Rate Matrix Range X Details screen to establish fuel pricing tiers to correspond to fuel surcharge breaks. For example, a typical fuel surcharge table may contain rates for every five to ten cent increase in fuel price beginning at $1.20. In a simplified example however, we will say there is a surcharge increase every 50 cents, therefore our example appears as follows.

Figure 19: View Rate Matrix Range X Details screen

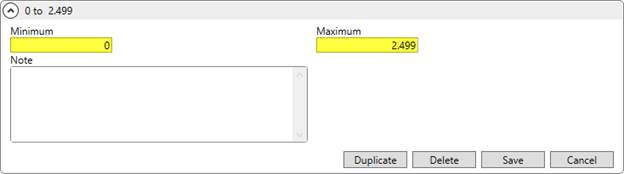

Each Range X value contains a Minimum and Maximum range to correspond to your fuel charge tiers. The following is the first record in our example.

Figure 20: X Range example

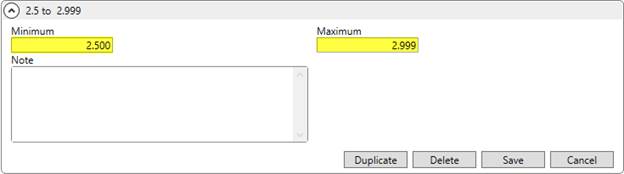

The second record appears as follows.

Figure 21: X Range example

Once all fuel price tiers are established, save and close out of the screen, and the next step is to assign the fuel surcharge rate to each tier. Click on the Rate Matrix button and add Rate values for each price range. Enter a fuel surcharge percentage of 10.50% as 10.50 for the Rate, for example.

Figure 22: Rate Matrix examples.

The new matrix is assignable to rates associated to one or more Rate Plans.

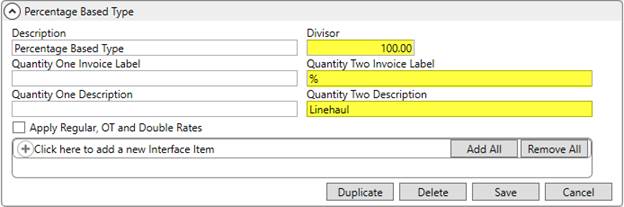

STEP 3: Add Rate Type Records to Support Fuel Surcharge

Establish a new Rate Type Setup record to support fuel surcharges. Set the Divisor to 100, based on the assumption that the amount is based on 100-weight pricing. Set the Quantity Two Invoice Label and Quantity Two Description accordingly.

Figure 23: Sample Rate Type Setup record

The Quantity Two Description is referenced by users when manually entering the dollar amount that fuel surcharge is based upon (see Step 5).

The Rate Type record is assignable to Rates within a Rate Plan.

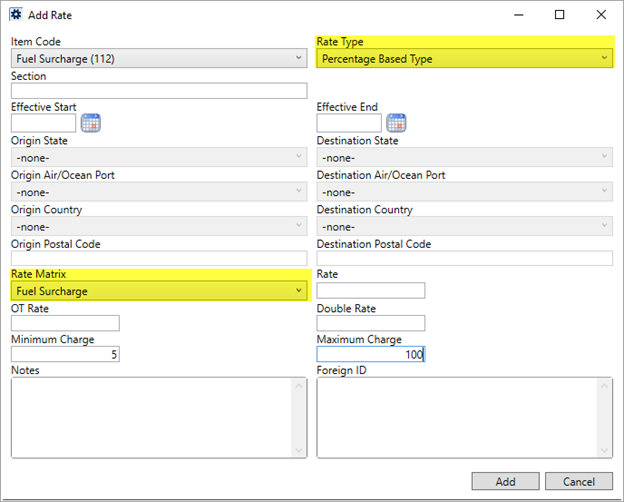

STEP 4: Update Rate Plans to Support Fuel Surcharge

Update Rate Plan Setup records by adding or updating Rates to reference the new Rate Type and Rate Matrix entries.

Figure 24: Rate example from Rate Plan Setup

Set other values as needed. For example, the Minimum Charge and Maximum Charge fields do compute a minimum and/or maximum line item amount when a Rate Matrix is in use. Rate, OT Rate, and Double Rate values, however, do not apply.

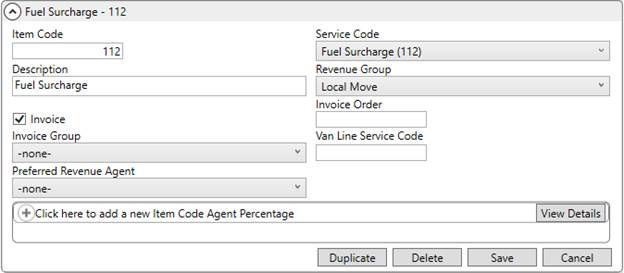

If a new Item Code is needed to support fuel surcharges, then establish one through Item Code Setup.

Figure 25: Item Code Setup

STEP 5: Verify Fuel Surcharge

Within MoversSuite, establish quote and/or revenue items that reference the Rates (Item Codes) established for the fuel surcharge. Generate invoices on these items, as well, and verify that the correct percentage rate is referenced for the specific Load Date of the order.

In the following example, a rate of 11.5% is pulled in on this order, as viewed through the Add Revenue Item screen.

Figure 26: Add Revenue Item screen

You can view which Fuel Cost is referenced to

determine the Rate through the  button. This opens the Edit Advanced Rating Basis

dialog.

button. This opens the Edit Advanced Rating Basis

dialog.

Figure 27: Edit Advanced Rating Basis

Fuel Cost referenced is a value pulled from Fuel Cost Setup (Step 1).

As a reminder, the Miles value is simply a placeholder and does not factor into the fuel surcharge calculation.

RELATED TOPICS:

Rating Systems Setup and Administration