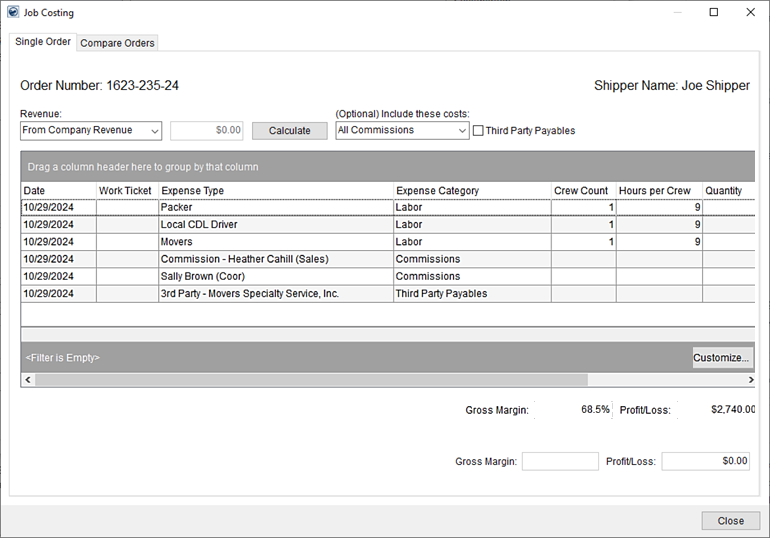

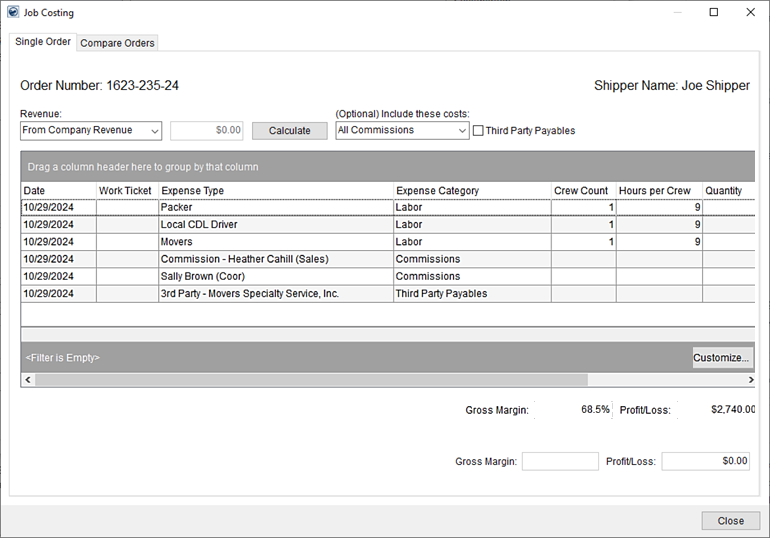

The Single Order tab is available through the Job Costing screen and provides costing information and anticipated revenue for a specific order. This application automatically displays costing information for the order currently being viewed in MoversSuite.

Figure 6: Single Order tab within Job Costing

NOTE: Job Costing data within the Single Order tab updates automatically as you switch between orders.

NOTE: The Cost column is only visible to managers. Refer to the Cost description in the table below for details.

The following table describes the fields and functions available within the Single Order tab within Job Costing.

|

Field/Function |

Description |

|

Order Number |

Current Order Number of the record being viewed displays. |

|

Shipper Name |

Name on the order being viewed, pulled from the Last Name/Company Name and First Name/MI fields on the Name, Address, Phone tab. |

|

Revenue |

Select the appropriate type used as the basis for the revenue on the job costing calculation, i.e. the source of the revenue needed for costing calculation. The following options are available and are used to determine what revenue amount is referenced for computing Gross Margin and Profit/Loss values.

From Accepted Quotes With this option, the anticipated revenue for costing calculations is pulled from the amount of all accepted quotes. View the Quote tab to see which quotes are included (Status of “Accepted”). The amount referenced displays in the amount field next to the selector.

From Company Revenue With this option, incorporate expenses for larger jobs into costing by including the following from Revenue Entry: Total Commission Paid and Third Party Expenses.

When this option is chosen on the Single Order tab, the “(Optional) Include these costs” dropdown and the “Third Party Payables” flag are prompted.

See “(Optional) Include these costs” in this table for details.

From Estimate Amount With this option, the application sets the anticipated revenue amount from what is set for the Estimate Amount set for the order on the Billing Information or Billing Information (Revenue Entry) tab. The amount referenced displays in the amount field next to this selector.

From Rated Amount The application compares the total of all rated items on the order (display within the Rated Amount column) to the computed cost (display within the Cost column) to determine the Gross Margin and Profit/Loss values, when you select this option. This is considered the billed amount of revenue for the order.

Manual Entry If you wish to enter a specific amount of revenue to base job costing on, then choose this option and enter an amount in the amount field adjacent to the selector.

Press Calculate to pull in the latest data on the order and recalculate Gross Margin and Profit/Loss amounts.

|

|

Actual Billed |

Once the Bill Date is set on the order, MoversSuite computes the Actual Billed amount from all revenue items (from all items listed within the Transactions tab for the order) and recalculates the finalized Gross Margin and Profit/Loss amounts.

NOTE: The Actual Billed amount displays beneath the Shipper Name when the Bill Date is set. The Bill Date is managed through the Order Information (Revenue Entry) tab.

|

|

|

When the Revenue source is “From Company Revenue” within the Single Order tab of Job Costing, the following options are available in the dropdown:

No Commissions The default option is to not include commissions in costing.

Non-Sales Commissions Include commissions created for drivers, coordinators, and other non-salespeople in costing. These people are identified as having a commission on a Labor Type other than “Sales”, such as “Coor”, “% Comp Driver”, etc. These items show under the Expense Category of “Commissions” along with the name of the user and their roles shown as the Expense Type, e.g., “Sally Brown (Coor).”

All Commissions Include all commissions created on the order in costing. This includes commissions associated with any Labor Type, including “Sales.” These items show under the Expense Category of “Commissions” along with “Commission – “ followed by the name of the user and their roles shown as the Expense Type, e.g., “Commission – Heather Cahill (Sales).”

|

|

|

Checking this option instructs the application to include all revenue payables in costing. These are created through the Add Third Party Item (Revenue Entry) dialog (Add Item > Third Party through the Transactions tab). These items show under an Expense Category of “Third Party Payables” along with “3rd Party – “ followed by the name of the vendor as the Expense Type.

NOTE: If you record these payables now using Third Party Services (available through the Billing Information tab), you may need to evaluate which option you choose for costing: Either utilize Third Party Payable or Third Party Services, since they both factoring into costing. Third Party Payables associate to revenue whereas Third Party Services do not. Refer to Third Party Services and Add Third Party Item (Revenue Entry) for details on each. |

|

Data Grid |

|

|

Right-Click Options The following options are available through a right-click menu in this grid.

Export To Export the contents of the grid to view and manage through an external application, such as Microsoft Excel. Refer to the Export To topic for details.

Export Selection To Export the highlighted records within the grid to view and manage through an external application, such as Microsoft Excel. Refer to the Export To topic for details.

| |

|

Date |

Date of the service displays. This is the date of the service created through Local Services and assigned to crew through Dispatch Center. |

|

Work Ticket |

The Work Ticket for the service displays. |

|

Expense Type |

The column displays the type assigned to the expensed item. See the Expense Category description for more information. |

|

Expense Category |

This is the general category of expenses as one of the following:

Equipment This is a general category for the equipment related expense items, such as the equipment assigned to the service through Local Dispatch. The description set for the Expense Type comes from Equipment Type Setup.

Labor This is a general category for expenses related to crew assigned to the service through Local Dispatch. The description set for the Expense Type comes from Labor Type Setup (and assigned to an employee through Personnel Setup). MoversSuite measures Labor in hours and it is combination of hourly wage and a Cost Benefits Percentage, which is a fixed percentage of wages to account for indirect cost related to the service or employee.

Material This is a general category for expenses associated to estimate counts set for the order within Containers, Packing and Unpacking (CPU) on the order and/or each service. The description set for the Expense Type comes from Material Type Setup.

Third Party This is a general category for third party services set for the order through the Third Part Services option on the Billing Information tab (see Add Third Party Item). The description set for the Expense Type comes from Description set with Add Third Party Item.

Refer to Job Costing Setup and Administration for details on the values and formulas used to calculate the cost for each of these types. |

|

Crew Count |

Number of people assigned for a Labor expense type displays. |

|

Hours per Crew |

Number of hours anticipated for each person to work under the service displays. |

|

Quantity |

This column displays the count of the particular expense, such as “2” for two hours labor for an assigned crew member. There is no quantity set for Third Party category items. |

|

Hourly Rate |

Hourly rate for the service work displays. |

|

Rated Amount |

In addition to costing data, your company can view the anticipated rated amount for expense items based on the Rate Plan assigned to the order. If the item is rated, an amount displays in this column. This provides an estimate that may be closer to what is billed for items on the order. Refer to Job Costing Rating for more information. |

|

Rate Type |

Displays the type of rating applied to the service as one of the following: Regular Double Time Overtime

The Rate Type applies to labor costs as well. |

|

Cost |

Cost computes as the anticipated cost assigned to an employee, material type, equipment, etc. multiplied by the Quantity. For example, if the Average Cost set for carton is $2.00 (set within Material Type Setup) and there are 20 cartons assigned to the service, then the application calculates a gross cost amount of $40.00. Third Party expenses show as the amount of the service.

NOTE: This column is only visible to personnel that have the Allow Manager Privileges flag set for the Job Costing module within their Security Profile Setup record.

|

|

Gross Margin and Profit/Loss | |

|

Gross Margin |

Calculated as the amount of Profit/Loss divided by the Revenue amount or Actual Billed amount (if finalized). Use Gross Margin to determine how close the profit or loss is to the revenue of an order (determines effectiveness of the estimation and service assignments). |

|

Profit/Loss |

This is the amount difference between original revenue amount and the costs associated to the order. Profit/Loss calculates as the Revenue amount or Actual Billed amount (if finalized) less the sum of all Cost items. If the Revenue amount is $500 and the total of all expenses is $350, then the profit is $150. |

|

|

Close (Alt+C) Press this button to close the Job Costing window. |