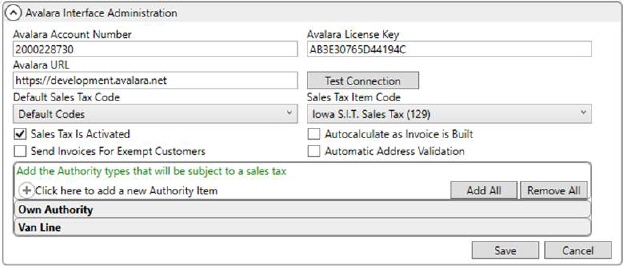

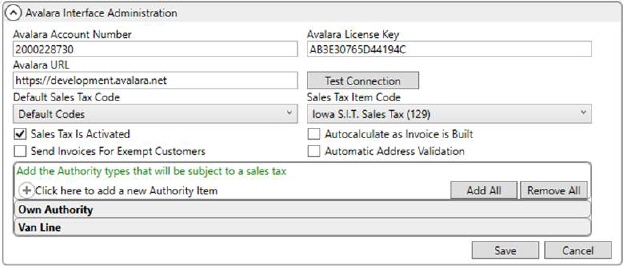

MoversSuite Administration > Accounting and Financial Services > Avalara Interface

Establish the interface supporting Sales Tax Integration for Avalara within this setup. Additionally, you can provide global settings that affect the Sales Tax Integration functionality as well, such as setting a default tax code, setting the Item Code utilized to document generated tax for accounting purposes, and enable the auto-calculation function.

Figure 42: Avalara Interface Setup

Technical Field and Function Information

|

Field |

Description |

|

Avalara Account Number |

Enter the service number for your company provided by Avalara (up to 32 characters). |

|

Avalara License Key |

Enter the license key for your company provided by Avalara (up to 32 characters). |

|

Avalara URL |

Enter the fully qualified URL to access your company account on the Avalara system (up to 64 characters), e.g. “https://youcrcompany.avalara.net.” |

|

|

Test Connection This function checks the connection to the Avalara system using the entered account, key, and URL. Once evoked, the Avalara Sales Tax Service Connection Test dialog appears displaying the progress of the validation along with the results. |

|

Default Sales Tax Code |

Optionally, select a default tax code record for Item Code assignment for special tax considerations. The options available are from those defined within Avalara Tax Code Setup. If no default is selected, then the system assigns the tax code based on the Item Code mappings defined within Avalara Tax Code Setup). |

|

Sales Tax Item Code |

Select the Item Code from the list of those defined within Item Code Setup to generate Sales Tax revenue under. Sales tax applied to revenue items are included in the Item Code set here. Sales tax information is available for generated items within the Transactions tab. |

|

|

Sales Tax is Activated Check this flag to activate Sales Tax Integration functionality on your system. Unchecking this option turns off the functionality for the entire system. |

|

|

Autocalculate as Invoice is Built Check this option to instruct the application to automatically compute the Sales Tax amount within New Complete Invoice. If this option is unchecked, users will need to compute the tax manually through the Calculate button, which appears next to the Sales Tax field. |

|

|

Send Invoices For Exempt Customers Check this option to instruct MoversSuite to send invoices for tax-exempt customers to Avalara . This option should only be checked if using Avalara for tax reporting. Setting this option sends invoices for tax exempt customers to Avalara for reporting purposes only; no sales tax is calculated. When this option is checked, the New Complete Invoice screen displays “Tax Exempt” near the customer invoice.

NOTE: Contents of the Tax Exempt 1 field in Microsoft Dynamics GP for the customer is sent along with the invoice (set in the Avalara ExemptionNo field).

|

|

|

Automatic Address Validation Check this flag to instruct the application to validate the invoice addresses for each revenue item prior to displaying the New Complete Invoice screen. Address errors encountered display in the Sales Tax Address Validation dialog. Only United States addresses are validated; Avalara does not calculate sales tax on foreign addresses. If this flag is not set, then the application validates the address when calculating and sending the sales tax with Avalara (when the New Complete Invoice screen is already open). |

|

Authority Item Details |

|

|

Authority Item |

Base Sales Tax generation on the authority of the order. For taxes to be computed, the authority must match what is listed in this section. If no match is found, then Sales Tax functionality is not available. See Authority Setup for details on the Authority field and the options available here. |

RELATED TOPIC: