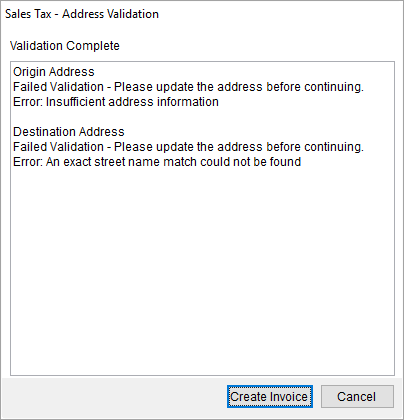

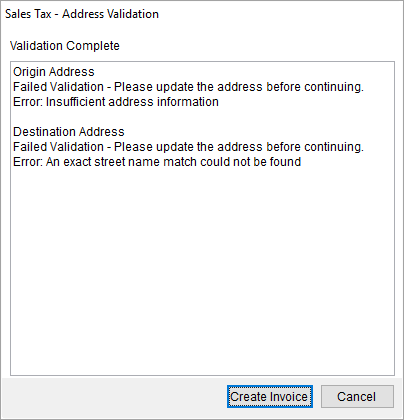

The Sales Tax Address Validation dialog appears when an address linked to a revenue item is incomplete or invalid. This dialog appears as you attempt to create or edit an invoice through the New Complete Invoice screen. Sales Tax Integration requires valid addresses.

Figure 37: Sales Tax Address Validation dialog

The Sales Tax Address Validation feature is only available when the Automatic Address Validation flag is checked within Avalara Interface Setup. If this flag is not checked and there are address errors, then they are returned to you when data is sent to Avalara.

The addresses referenced by this dialog are those set on the order and referenced by the revenue item through the Point of Service setting within Add Revenue Item or Add Revenue Group. Cross reference the Point of Service to the order addresses specified within Sales Tax Integration Referenced Fields to identify the missing or invalid address.

Press Create Invoice to continue to the New Complete Invoice screen without correcting any address errors.

Technical Field and Function Information

The following table describes the fields and functions that display within this dialog.

|

Field/Function |

Description |

|

Validation Complete |

The application processes all addresses associated to all featured revenue items and returns a list of errors associated to each address. The address type specified, e.g. Origin Address, is documented within the Sales Tax Integration Referenced Fields topic and links to the Point of Service setting on the revenue item established within Add Revenue Item or Add Revenue Group. |

|

|

Create Invoice Press this button to continue to the New Complete Invoice screen without correcting the incorrect addresses. |

|

|

Cancel Press this button to cancel invoice creation. |

RELATED TOPICS: